Building a Basel Model in Credit Risk

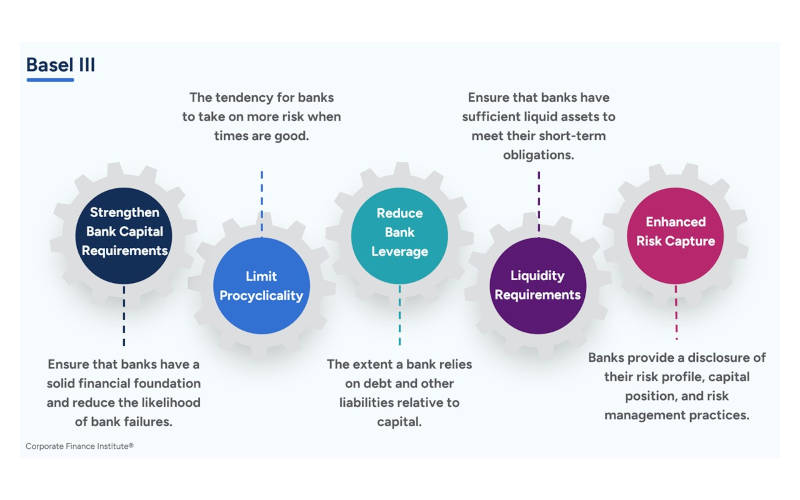

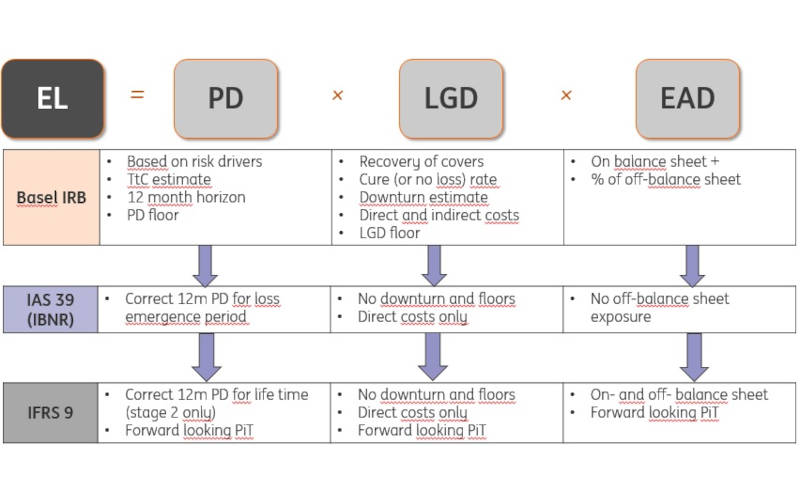

Building a Basel model is one of the most important and regulated activities in banking. Unlike generic predictive models, Basel models directly influence regulatory capital, portfolio strategy, pricing, and risk appetite. Regulators expect these models to be conceptually sound, statistically robust, well-governed, and auditable. The Journey of Building a Basel Model Building a Basel-compliant credit […]

Building a Basel Model in Credit Risk Read More »