In general, expected credit loss as the name suggests is the expected loss from a loan exposure. On the other hand, unexpected credit loss is the loss that exceeds the expectations. Credit loss, a fundamental risk in financial institutions, is the economic loss resulting from a borrower’s inability to meet their financial obligations. Whenever a bank lends money to its borrowers, it is expected to have some credit risk – the risk of not getting back the money from the borrower. In this case, the bank is exposed to two types of losses – Expected Credit Loss (ECL) & Unexpected Credit Loss (UCL).

Expected Credit Loss (ECL)

ECL is the portion of a bank’s credit portfolio that is anticipated to be lost due to default. It is a forward-looking estimate that considers the probability of default, the loss given default (LGD), and the exposure at default (EAD). Banks are required to recognize ECL as a provision in their financial statements, reflecting the potential credit losses they anticipate. Banks are required to recognize ECL as an impairment loss in their financial statements.

Factors Influencing Expected Credit Loss (ECL)

Expected Credit Loss (ECL) is a measure of the potential loss a lender may incur due to a borrower’s inability to repay a debt. Several factors can influence the ECL of a loan. Here’s a breakdown of some key factors like:

- Economic conditions: Economic downturns can increase unemployment, reduce consumer spending, and strain businesses, leading to higher default rates. Rising interest rates are also an indicator.

- Borrower characteristics: Factors like credit history, income level, collateral value, loan-to-value ratio can influence the probability of default.

- Loan terms: The maturity of the loan, interest rate, and collateral requirements can affect the risk profile.

- Lender-specific factors: A lender’s willingness, effective risk management strategies, including credit scoring, underwriting, and monitoring, can help lenders identify and mitigate credit risk. A lender’s diversified loan portfolio can also reduce their exposure to credit risk by spreading it across different borrowers and industries.

Read more: Understanding the Credit Conversion Factor

Unexpected Credit Loss (UCL)

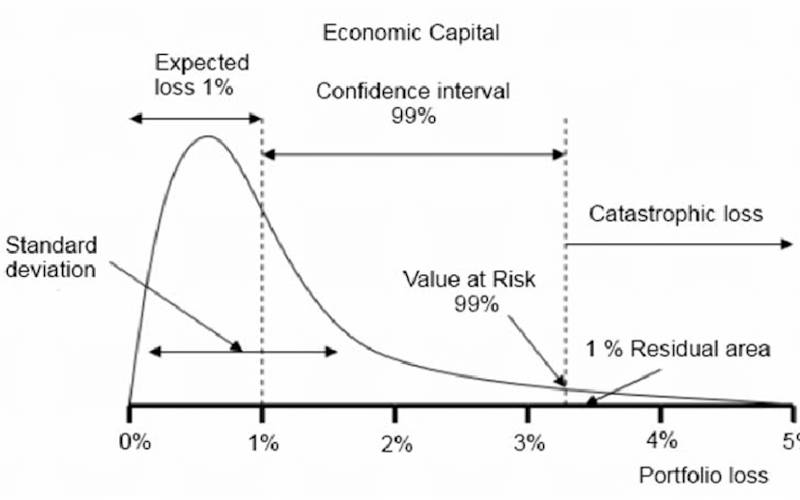

Unexpected credit loss is the portion of the credit loss that exceeds the expected credit loss. It represents the unforeseen credit events that the bank was unable to anticipate or adequately account for in its ECL calculations. UCL is often associated with extreme events, such as economic crises or systemic failures.

Factors Influencing Unexpected Credit Loss (UCL)

- Economic downturns: During economic recessions, borrowers may face financial difficulties that lead to defaults.

- Changes in industry dynamics: Shifts in market conditions or industry trends can impact borrowers’ ability to repay their loans.

- Unexpected events: Natural disasters, geopolitical events, or unforeseen circumstances can disrupt businesses and lead to defaults.

- Underestimation of borrower risk: If a lender fails to accurately assess a borrower’s creditworthiness, they may experience unexpected losses.

- Fraud or misrepresentation: Instances of fraud or misrepresentation by borrowers can result in unexpected credit losses.

The Relationship Between ECL and UCL

While ECL and UCL are distinct concepts, they are interconnected in a way. Here’s a breakdown of their relationship:

- Complementary Components: ECL and UCL together constitute the total credit loss. In other words, the total credit loss equals the sum of ECL and UCL.

- Risk Management Tool: ECL is used as a risk management tool to set aside adequate provisions for potential credit losses. By recognizing expected losses upfront, financial institutions can better manage their capital and liquidity.

- UCL as Residual Risk: UCL represents the residual risk that remains after accounting for ECL. It’s the portion of the credit loss that cannot be anticipated or adequately provided for.

- Impact on Capital Requirements: Regulators often require financial institutions to maintain sufficient capital reserves to absorb UCL. This helps ensure the stability of the financial system.

- Factors Affecting the Relationship: The relationship between ECL and UCL can be influenced by various factors, including:

- Economic Conditions: Economic downturns can increase UCL as borrowers’ ability to repay may deteriorate unexpectedly.

- Credit Quality: Borrowers with lower credit quality are more likely to experience higher UCL.

- Loan Portfolio Composition: The diversity and concentration of a loan portfolio can impact the level of ECL and UCL.

- Risk Management Practices: Effective risk management practices can help reduce UCL by identifying and mitigating potential credit risks.

Calculating ECL and UCL

The calculation of ECL and UCL involves complex methodologies that vary depending on the specific regulatory framework and the nature of the financial institution. However, some common approaches include:

- Probability of default (PD): This is the likelihood that a borrower will fail to meet their contractual obligations. It is typically estimated using statistical models based on historical data, credit scoring, and other relevant factors.

- Loss given default (LGD): This represents the percentage of the exposure that a bank expects to lose if a borrower defaults. It can be influenced by factors such as collateral, guarantees, and recovery procedures.

- Exposure at default (EAD): This is the amount of money a bank is exposed to at the time of default. It can be affected by factors like credit lines, derivatives, and other contractual arrangements.

ECL is typically calculated as PD * LGD * EAD. UCL however can be estimated as the difference between the total credit loss and ECL.

Also read: Survival Analysis in Banking

Difference between ECL and UCL

- Time Horizon: ECL considers the entire expected life of financial instruments, while UCL focuses on unexpected losses over and above the expected credit losses within a specific time frame.

- Purpose: ECL is crucial for day-to-day provisioning and financial reporting, providing a comprehensive view of credit risk. UCL, on the other hand, aids in understanding and preparing for potential losses beyond what is expected, enhancing risk management practices.

- Calculation Methods: ECL is often computed using complex models that consider historical data, current conditions, and forward-looking estimates. UCL calculations involve stress testing, scenario analysis, and statistical methods to assess the impact of extreme events on credit risk.

Conclusion:-

ECL and UCL are essential concepts in credit risk management. They are complementary aspects of the same loss distribution. Availability of quality data is essential to derive accurate results. By understanding their relationship and the factors that influence them, financial institutions can better assess their credit risk exposure and allocate capital accordingly. Effective management of both ECL and UCL is crucial for ensuring the financial stability of institutions and the broader economy.