Credit Risk Assessment and Big Data Analytics

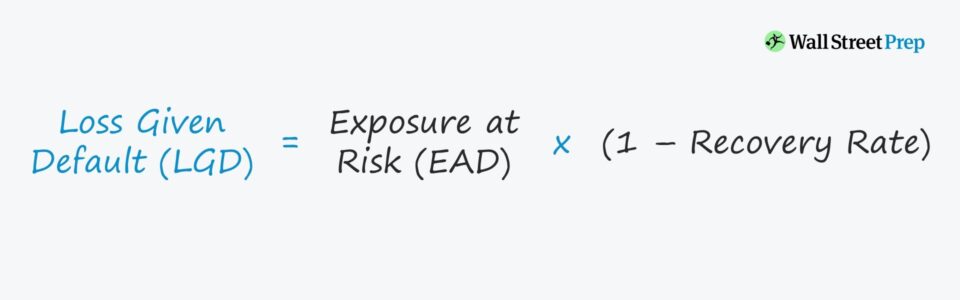

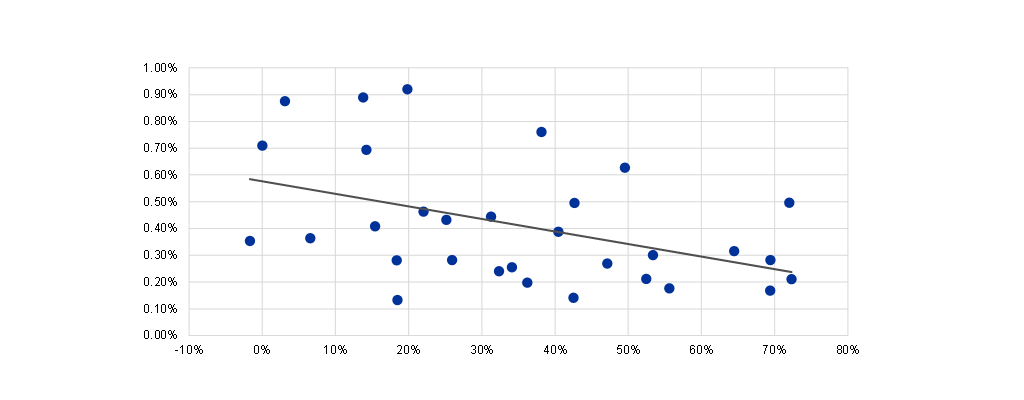

Credit risk assessment or analysis is the analysis of historical data for understanding of a borrower’s creditworthiness or assessment of the risk involved in the granting of a loan. The outcome of the analysis helps banks and financial institutions to evaluate their risks as well as their customers. The aim of credit risk assessment is […]

Credit Risk Assessment and Big Data Analytics Read More »