Understanding Probability of Default-PD Model for Mortgages

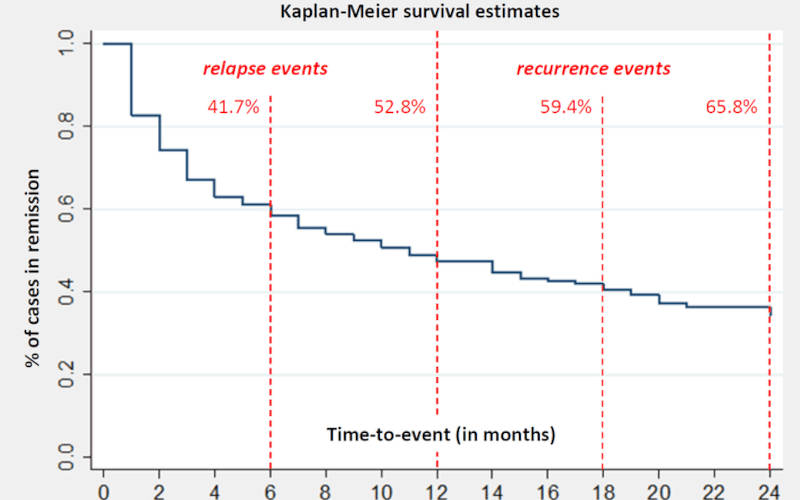

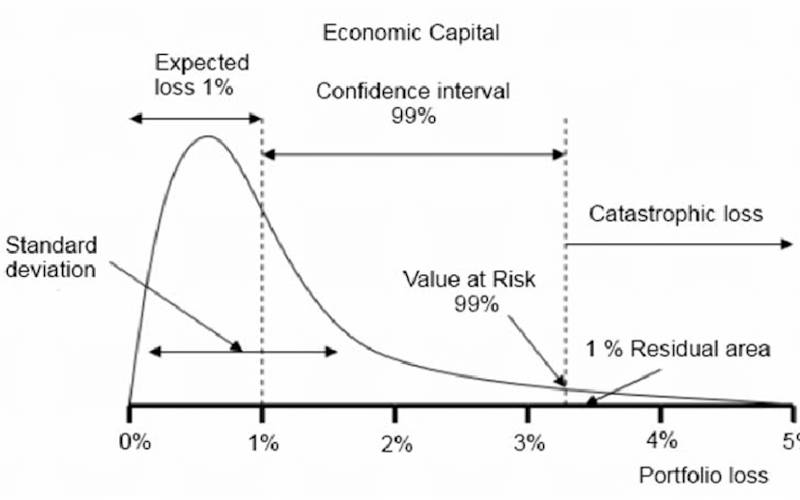

Mortgages play a central role in financial systems. In Probability of Default or PD model for mortgages are evaluated for likelihood of borrower to fail

Understanding Probability of Default-PD Model for Mortgages Read More »