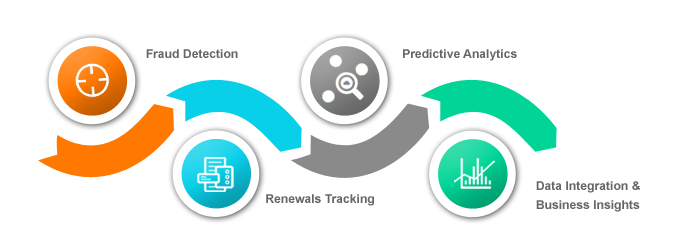

In this age of Big Data and Artificial Intelligence, predictive analytics is helping reshape the insurance industry. There has been a massive shift in the current way insurance companies operate. Predictive modeling uses various data mining techniques, artificial intelligence, ML models, DL methods to interpret the data. Earlier there were dependencies on actuaries to predict the likelihood of property loss and damage using mathematical models. Nowadays insurance firms uses data analytics to maximize their investments.

Ways in which Predictive Analytics Shapes Health Insurance Industry

Predictive Analytics on Improvement of Risk Model Accuracy

Using predictive analytics, adjustment of data models can be automated. With this, underwriters can make even more accurate predictions about a client’s risk profile. This also saves the actuaries’ a lot of time and effort. Due to the increased variety of data sources which can actually provide first-hand information, the insights derived are extremely valuable. In addition to that, if operational automation is in place, that itself would save million of dollars a year in additional revenue and cost savings.

Identifying customers at risk

Predictive analytics in property & casualty (P&C) insurance helps carriers identify and segregate customers who are at a high risk. It can help prioritize customers who are quite likely to lower or even cancel their coverage. Deeper insights also helps track customers who are unhappy with their present coverage. Companies with this information at hand can easily provide personalized attention and resolve issues. Similarly, insurers can attend to high-risk patients to reduce inpatient admissions and emergency room visits.

Identify Outlier Claims

Usage of predictive analytics can provide advance notification of potential high-cost losses. These are outlier claims. Even before a claim is filed, insurance companies can make use of previous outlier claims data to chalk out alternatives for similar situations arising in future.

Personalized Premiums

Gone are the days of one-size-fits-all premiums. Predictive analytics allows insurers to personalize premiums based on an individual’s unique health profile. If you’re someone who actively manages their well-being, your premiums might reflect the lower risk associated with your lifestyle. This not only benefits the health-conscious but also creates a fairer system where individuals are rewarded for their efforts to stay healthy.

Improvement of Claim Processing

Insurers use historical data to understand the pattern of claims. This kind of analysis can help in trend analysis, expense management, resource allocation, early warning of potentially high-value loss, etc.

Identification of Potential Market

Data can reveal demographics and some common behavioral patterns which can tap new unexplored markets. By understanding customer behaviour, it can help in determining policy premiums. It also influences customer service. When it comes to obtaining answers and resolving problems, most of the answers lie in social media.

Behavioral Biometrics can prevent fraud

Behavioral Biometrics helps companies detect scams, aids identity proofing, continuous authentication and account takeover fraud. Using this technique, companies can verify if the person logged in, is genuine or not. Voice biometrics is often used for this purpose, when verification is done over phone. Thus, these advanced processes have always enhanced identification protocols.

Improving Health Outcomes

Beyond the financial aspects, predictive analytics plays a crucial role in improving health outcomes. Insurers can proactively reach out to policyholders who may be at risk of developing certain conditions. This could involve providing resources, information, or even incentives to encourage healthier choices. By focusing on preventive measures, insurers contribute to a healthier society while reducing the financial burden associated with treating advanced health issues.

Reasons why Companies invest in Predictive Analytics

- Usage of predictive in insurance industry is just at it’s infancy.

- Having a proper analytics process in place adds leverage to a company. It helps to identify customers who are most likely to switch vendors. The company then can give incentives to the priority customers.

- Proper analysis of claims data helps fraudulent activities and extract overpayment from them, if any.

- Predictive analytics enhances revenue growth over companies who do not use or are yet to adopt this technology.

- Data is the most valuable asset any industry has. With proper technology and tools, this data can be managed properly that can in return help make robust customer profiles, provide cross-sell and up sell opportunities and also forecast potential customer profitability. With the help of insurance data models. Cloud services are also provided with the help of insurance data models.

- In order to stay ahead of the game, many of the legacy players are choosing to invest in and adopt their own AI and technological solutions. Investments range from car sensors to drones and IoT devices.

The Road Ahead

The role of predictive analytics in the health insurance industry will only grow with the technology advancement. Insurers that embrace this tool will not only gain a competitive edge but also will contribute to a more sustainable and efficient healthcare system.

In conclusion, predictive analytics is reshaping the health insurance landscape, making it more personalized, efficient, and focused on prevention rather than just treatment. As a policyholder, this means a more tailored and proactive approach to your health, ensuring that your insurance experience is not just a safety net but a true partner in your well-being.