In the realm of finance and credit risk management, the concept of Loss Given Default (LGD) plays a crucial role. It involves identifying, assessing, and mitigating potential losses that could arise from various factors, such as market fluctuations, credit defaults, and operational failures. Among these risks, credit risk stands out as a significant concern for financial institutions. This encompasses the possibility of borrowers defaulting on their loans or other credit obligations.

To effectively manage credit risk, financial institutions employ various tools and techniques, including the ‘Loss Given Default’ (LGD) model. This model plays a vital role in estimating the potential financial loss that a lender might incur in the event of a borrower’s default. Clearly by understanding and applying LGD models, financial institutions can make informed decisions. Some of them include creditworthiness, loan pricing, and also some risk mitigation strategies.

What is Loss Given Default (LGD)?

Loss Given Default (LGD) represents the estimated proportion of a loan or other credit exposure that is not recovered in the event of a borrower’s default. It is a percentage of the total outstanding loan balance at the time of default. For instance, if an LGD of 50% is assigned to a $100,000 loan, it implies that the lender expects to recover only $50,000 upon default, resulting in a loss of $50,000. LGD is typically expressed as a percentage, ranging from 0% (complete recovery) to 100% (no recovery).

Purpose of LGD Models

LGD models serve several critical purposes in credit risk management:

- Credit Risk Assessment: LGD models provide valuable insights into the potential financial losses associated with individual borrowers or loan portfolios. This information is crucial for assessing creditworthiness and determining appropriate lending terms.

- Loan Pricing: LGD models play a role in determining loan pricing, as lenders consider the expected losses when setting interest rates and fees. Higher LGD estimates typically lead to higher borrowing costs for borrowers.

- Regulatory Compliance: Financial institutions are often required by regulatory bodies to maintain adequate capital reserves to cover potential credit losses. LGD models are used to estimate these capital requirements.

- Risk Mitigation Strategies: LGD models can identify and prioritize borrowers with higher default risk. This allows lenders to implement targeted risk mitigation strategies, such as collateral requirements or loan covenants.

Types of LGD Models

Several different approaches can be used to develop LGD models. Two common types are:

- Qualitative Scorecard Approach: This method utilizes expert judgment and historical data to assign creditworthiness scores to borrowers. These scores are based on factors such as industry, financial health, and borrower characteristics. These scores are then mapped to LGD estimates.

- Quantitative Statistical Approach: This approach employs statistical techniques to analyze historical default data and identify patterns that can be used to predict future defaults and associated loss amounts.

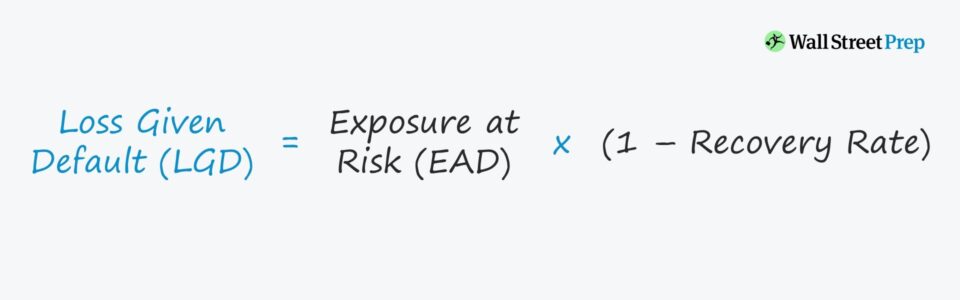

Calculating Loss Given Default

The most commonly used methods for modeling of LGDs are linear regression and decision trees. The linear regression includes robust and quantile regression as extensions to handle outliers. Decision trees are mainly favored by banks as they offer interpretability and the leaf values can be directly interpreted as LGD grades. Estimating LGD is a complex process that involves analyzing historical data, considering economic factors, and employing various statistical techniques. Two primary approaches are commonly used:

Historical Data Analysis: This method involves examining historical default events and recovery rates to derive LGD estimates for different loan types and borrower characteristics.

Statistical Modeling: Statistical models are developed using historical data and economic variables to predict LGD for specific borrowers or loan portfolios. These models often incorporate factors such as collateral value, borrower creditworthiness, and macroeconomic conditions.

Factors Influencing Loss Given Default

Various factors influence the Loss Given Default of a loan or credit exposure:

- Collateral: The presence of collateral, such as real estate or equipment, can reduce the lender’s potential loss in the event of default.

- Borrower Characteristics: Factors such as industry, financial strength, and credit history can influence the likelihood of default and the extent of losses.

- Economic Conditions: Macroeconomic factors such as economic growth, unemployment rates, and industry-specific trends can influence the likelihood of default and subsequent recovery rates, affecting LGD estimates.

Application of LGD Models in Credit Risk Management

LGD models are widely used in various aspects of credit risk management:

- Credit Underwriting: LGD models can assess the creditworthiness of potential borrowers. This in turn determines the appropriate risk pricing for loans.

- Loan Portfolio Management: LGD models can evaluate the overall credit risk profile of a loan portfolio and identify areas of potential concern.

- Regulatory Capital Requirements: LGD models can also estimate the capital reserves required to cover potential credit losses, as mandated by regulatory bodies.

- Stress Testing and Scenario Analysis: LGD models are incorporated into stress testing and scenario analysis exercises. These in turn help to assess the impact of various economic and financial shocks on credit risk.

Conclusion

Lastly we see that understanding ‘Loss Given Default’ (LGD) is essential for financial institutions in order to effectively manage credit risk. Thus making informed lending decisions and maintain financial stability. LGD provides valuable insights into the severity of potential losses upon borrower defaults. Thus enabling lenders to assess creditworthiness, price loans appropriately, and allocate capital prudently. Credit risk still remains a critical concern in the financial industry.

Here LGD model continues to play a pivotal role in ensuring the sound management of credit exposures. This critical metric helps financial institutions assess their potential losses and make informed decisions regarding credit risk mitigation strategies. This also helps with the overall health of financial institutions.

Cover image credit : wallstreetprep.com